Crypto Coins Generator An Essential Tool For Enthusiasts

Crypto coins generators are becoming increasingly important in today’s digital currency landscape. These innovative tools assist users and developers in effortlessly creating their own cryptocurrencies, providing a gateway into the vast world of blockchain technology. With the surge of interest in cryptocurrencies, understanding how these generators function and their potential benefits is crucial.

At their core, crypto coins generators simplify the complex process of coin creation, offering various functionalities and features tailored to meet different user needs. Whether you're a novice looking to dip your toes into cryptocurrency or a seasoned developer aiming to streamline the coin creation process, these generators provide valuable insights and tools.

Overview of Crypto Coins Generator

Crypto coins generators are tools designed to create new cryptocurrency coins in the digital landscape. Their primary purpose is to simplify the process of coin creation, making it more accessible for users who may not have extensive technical knowledge. These generators operate within the cryptocurrency ecosystem by providing user-friendly interfaces that guide users through the coin creation process, often automating many of the complex steps involved.The significance of crypto coins generators for both users and developers cannot be overstated.

For users, these tools allow for experimentation and innovation without the need for deep programming skills. Developers benefit by saving time and resources, enabling them to focus on more critical aspects of their projects.

Types of Crypto Coins Generators

Several types of crypto coins generators are available in the market, each tailored to different user needs and technical expertise. Here are some of the main categories:

- Web-based Generators: These are accessible via a web browser and require minimal setup. They often offer templates and customize features for easy coin creation.

- Software Applications: This category includes downloadable software that users can install on their computers. These applications often provide more advanced features but may require more technical knowledge.

- Command-Line Tools: Designed for developers, these tools provide complete control over the coin creation process, allowing for extensive customization but requiring a strong understanding of coding.

Some popular crypto coins generators include:

- CoinLaunch: A web-based platform that helps users create and launch their coins with built-in marketing tools.

- TokenMint: A user-friendly software application aimed at simplifying the creation of tokens on various blockchains.

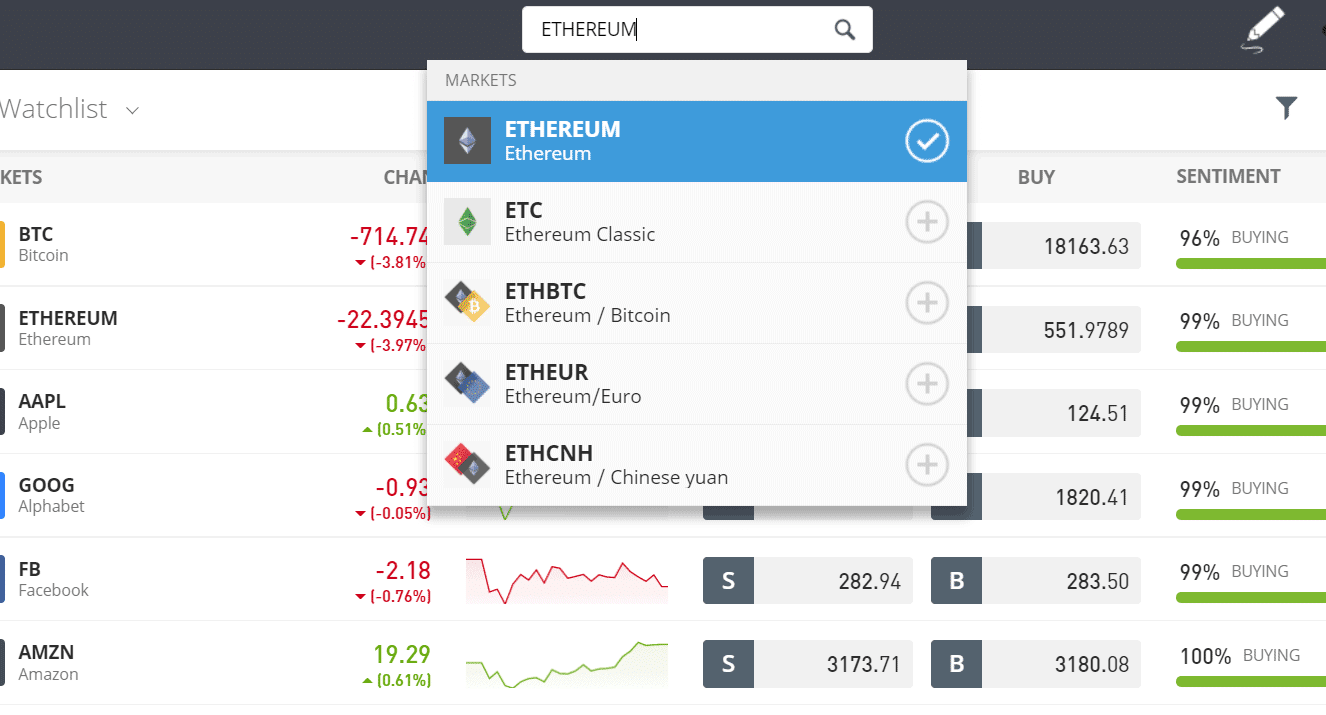

- Ethereum Token Generator: A command-line tool specifically for creating tokens on the Ethereum network with detailed customization options.

How to Use a Crypto Coins Generator

Effective use of a crypto coins generator involves several steps to ensure a smooth experience. Here’s a step-by-step guide:

- Choose the Right Generator: Select a generator that fits your technical skill level and meets your specific needs.

- Set Up an Account: If required, create an account on the chosen platform to access its features.

- Select Coin Parameters: Input essential information such as coin name, symbol, total supply, and any unique features.

- Customize Features: Utilize any customization options to make your coin stand out, such as transaction speed or consensus mechanisms.

- Generate Your Coin: Follow the prompts to create your coin, which may take a few moments.

- Test Your Coin: Conduct tests to ensure everything works correctly before launching.

- Launch and Promote: Once satisfied with the outcome, launch your coin and start promoting it within the community.

When using these generators, users should take several precautions:

- Ensure the generator is from a reputable source to avoid scams.

- Keep personal information secure and avoid sharing sensitive data.

- Understand the regulatory implications of launching a new coin in your jurisdiction.

Best practices for maximizing benefits include continuously educating oneself about cryptocurrency trends and actively engaging with the crypto community.

Benefits of Using Crypto Coins Generators

Utilizing crypto coins generators offers numerous advantages for users. One of the main benefits is the significant reduction in time and effort typically required for coin creation. Users can create a coin in a matter of hours, rather than weeks or months needed for traditional development methods.For developers, these tools can streamline the development process, allowing them to allocate resources more effectively.

The cost-effectiveness of using generators compared to conventional methods is profound. Many generators offer free or low-cost options, making it easier for startups to enter the market without heavy financial burdens.

Challenges and Risks Associated with Crypto Coins Generators

Despite their many benefits, crypto coins generators come with their fair share of challenges and risks. Users may encounter issues with generating coins that do not function correctly or lack essential features. Additionally, the presence of fraudulent generators poses a significant risk, with scams targeting inexperienced users.Common scams include fake generators that promise free coins in exchange for personal information or upfront payments.

Users should be vigilant and conduct thorough research before selecting a generator.To mitigate risks, it is crucial for users to:

- Verify the authenticity of the generator by researching reviews and user feedback.

- Look for community support and documentation that provides insights into the generator's reliability.

- Engage with experienced users to learn about potential pitfalls and best practices.

Future Trends in Crypto Coins Generators

As the cryptocurrency landscape evolves, so do crypto coins generators. Emerging trends include the integration of artificial intelligence to enhance user experience and automate complex processes. Additionally, the rise of decentralized finance (DeFi) is prompting the development of generators that enable users to create coins with unique DeFi functionalities.Advancements in blockchain technology are also set to influence the development of these tools.

For instance, improvements in scalability and speed may lead to more efficient coin creation processes.Looking ahead, users can expect increased accessibility and versatility in crypto coins generators, catering to a broader audience and enabling more innovative projects to emerge.

Regulatory Considerations for Crypto Coins Generators

The regulatory environment surrounding crypto coins generators is continually evolving. Currently, regulations vary significantly across different jurisdictions, impacting how these tools can be utilized. Users and developers must stay informed about the legal landscape in their region to ensure compliance.Key considerations include understanding the legal classification of the coins being created, potential tax implications, and adhering to anti-money laundering (AML) laws.

As authorities continue to refine regulations, staying ahead of compliance requirements is essential for successful coin launches.With a growing focus on consumer protection and market integrity, the future of crypto coins generators will likely be influenced by increased regulatory scrutiny, necessitating a proactive approach by users and developers alike.

Concluding Remarks

In conclusion, crypto coins generators represent a significant evolution in the cryptocurrency ecosystem, allowing both individuals and businesses to harness the power of digital currencies. As technology continues to advance, the potential for these generators will only expand, making them an indispensable resource for anyone interested in the crypto space. Embracing these tools could not only save time and resources but also enhance innovation and creativity within the industry.

Answers to Common Questions

What is a crypto coins generator?

A crypto coins generator is a tool or software that allows users to create their own cryptocurrencies with ease.

Are crypto coins generators safe to use?

While many generators are legitimate, it's essential to research and use reputable platforms to avoid scams.

Can I make money using a crypto coins generator?

Potentially, yes! However, success depends on market conditions and the demand for the created coins.

What types of crypto coins can I create?

You can create various types of coins, including tokens, utility coins, and reward coins, depending on the generator's capabilities.

Do I need coding skills to use a crypto coins generator?

No, many generators are designed for users without technical expertise, featuring user-friendly interfaces.