xrp coin chart Insights and Future Trends

Exploring the xrp coin chart offers a fascinating look into one of the most significant players in the cryptocurrency market. XRP, known for its fast transaction speeds and low fees, has garnered attention from traders and investors alike. Understanding the intricacies of the xrp coin chart not only helps in making informed trading decisions but also reveals the potential future trajectory of this digital asset.

This guide will break down the importance of XRP, analyze its historical performance, and provide insights into tools and strategies for reading charts effectively. By diving into the elements that drive XRP's price movements, you'll gain a comprehensive understanding of how to navigate this dynamic market.

Introduction to XRP Coin

XRP, often referred to as Ripple, is a digital currency that serves a vital role in the cryptocurrency market. Originally developed by Ripple Labs, XRP aims to provide a fast and cost-effective method for transferring money across borders. The significance of XRP lies in its ability to facilitate instant transactions and reduce the costs associated with traditional banking methods.Since its inception in 2012, XRP has undergone significant evolution.

Initially created to enhance the efficiency of cross-border payments, XRP quickly gained traction among financial institutions and payment providers. Its purpose is not only to act as a digital currency but also to serve as a bridge currency for various fiat currencies, thereby enabling seamless transactions between different currencies.

Understanding the XRP Coin Chart

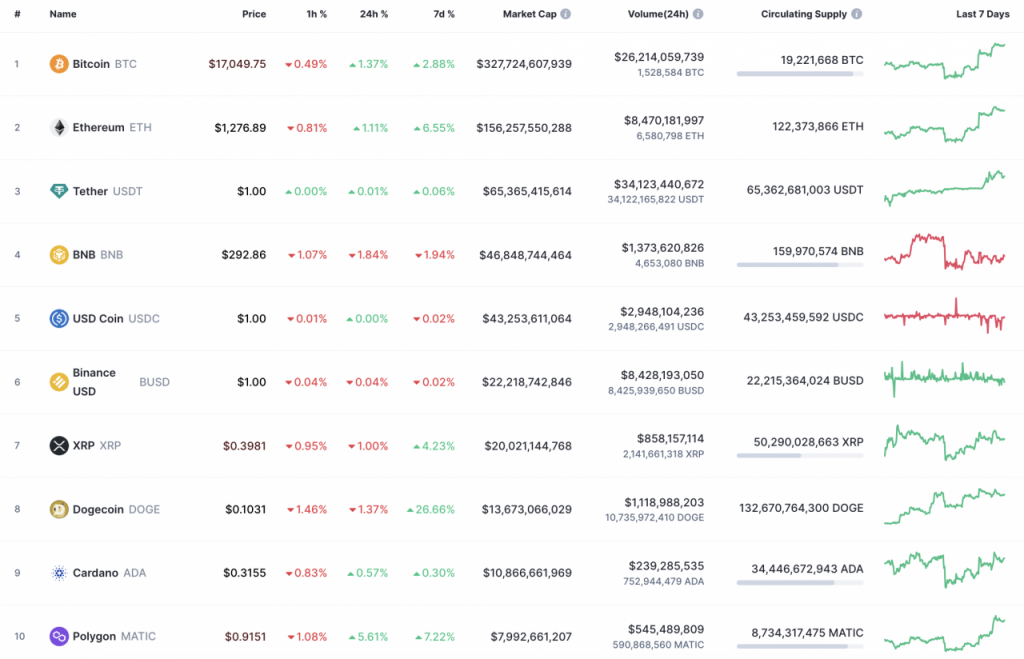

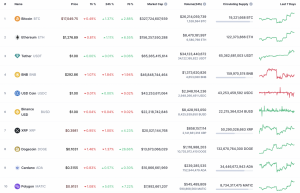

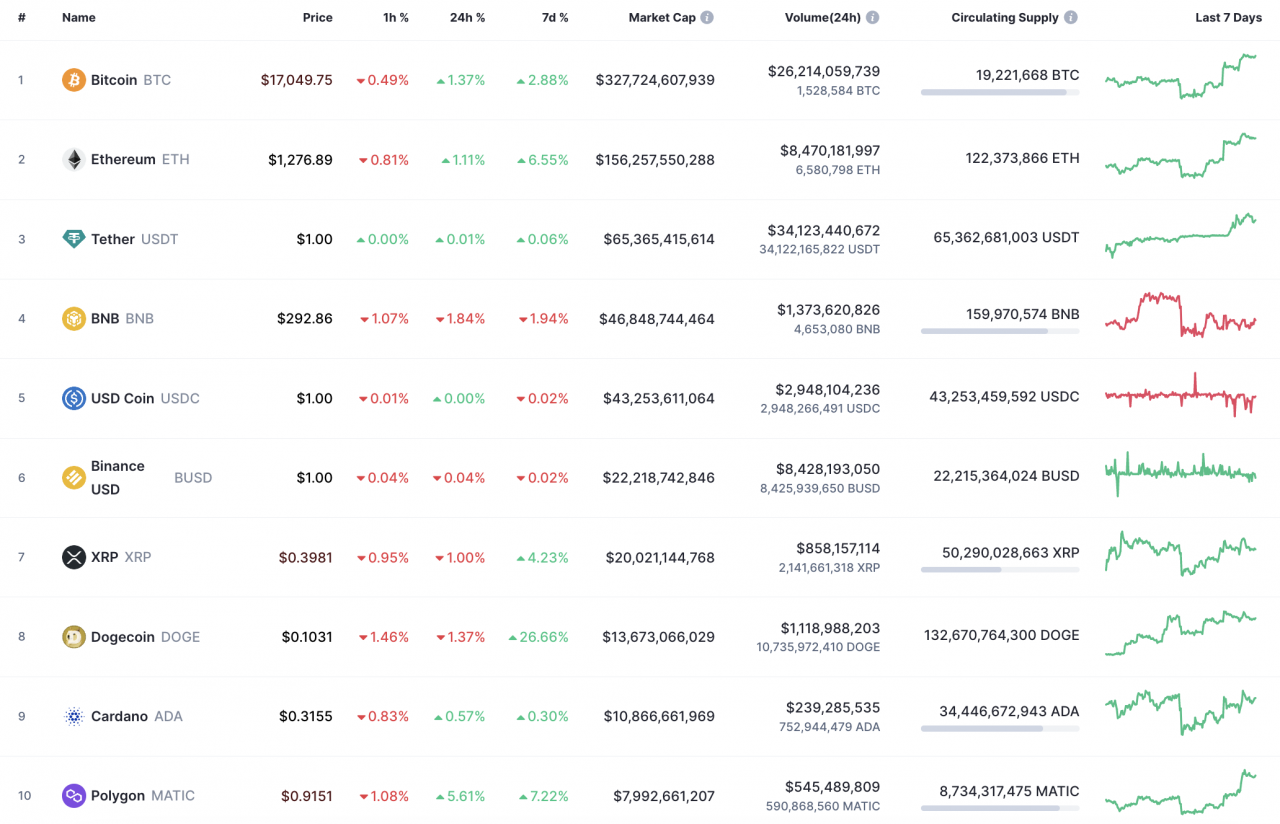

An XRP coin chart is a graphical representation that shows the price movements of XRP over time. This chart is crucial for traders as it helps them analyze market trends and make informed trading decisions. By studying the chart, traders can identify potential entry and exit points based on price fluctuations.The XRP coin chart comprises several components including price, trading volume, and market capitalization.

Price indicates the current value of XRP, while volume represents the total amount of XRP traded within a specific timeframe. Market cap, on the other hand, provides insights into the overall market value of XRP.Traders can interpret various patterns found in XRP charts. For example, a bullish trend indicates that the price is consistently rising, while a bearish trend shows a decline.

Recognizing these patterns allows traders to strategize their trades more effectively.

Analyzing Historical Data

Gathering historical price data for XRP is essential for understanding its market performance over time. Traders typically analyze price movements by collecting data from reputable crypto exchanges and aggregators. This data can be organized into a table format to showcase significant price milestones.

| Date | Price (USD) | Milestone |

|---|---|---|

| 2013-08-02 | 0.005 | Initial Launch |

| 2017-01-04 | 3.84 | All-Time High |

| 2020-11-24 | 0.60 | Market Recovery |

Past performance of XRP can significantly influence future price movements. Historical data provides insight into how XRP reacted to market events, helping traders anticipate potential future scenarios.

Tools for Charting XRP

Several popular tools and platforms are available for charting XRP prices, providing traders with essential resources to visualize market trends. Some of the widely used tools include TradingView, Coinigy, and CryptoCompare.When using a specific charting tool, traders can analyze price movements by adjusting various parameters such as timeframes, indicators, and chart types. For instance, a trader might choose a candlestick chart with a daily timeframe to observe short-term trends.Features to look for in an effective charting tool include:

- User-friendly interface

- Real-time data updates

- Customization options for chart types and indicators

- Integration with multiple exchanges

- Advanced technical analysis tools

Technical Indicators for XRP Trading

Various technical indicators can be applied to XRP charts to enhance trading decisions. Common indicators include Moving Averages, Relative Strength Index (RSI), and Bollinger Bands.

| Indicator | Formula | Interpretation |

|---|---|---|

| Moving Average | Sum of prices over n periods / n | Identifies trend direction |

| RSI | 100 - (100 / (1 + RS)) | Indicates overbought or oversold conditions |

| Bollinger Bands | MA ± (2

|

Measures price volatility |

Strategies for combining multiple indicators can lead to more accurate trading signals. For example, using RSI in conjunction with Moving Averages can help confirm trend reversals or continuations.

Market Sentiment and XRP Pricing

Several factors influence market sentiment surrounding XRP, including regulatory news, technological advancements, and partnerships with financial institutions. These elements can cause significant price fluctuations and affect trader behavior.News events such as legal developments or new partnerships can sway market sentiment positively or negatively. For traders, understanding how these events impact XRP coin charts is crucial for making timely decisions.Methods to gauge market sentiment for better trading outcomes include:

- Monitoring social media platforms for community discussions

- Analyzing news articles and press releases

- Utilizing sentiment analysis tools to track overall market mood

- Observing trading volume spikes in response to news

Future Projections for XRP

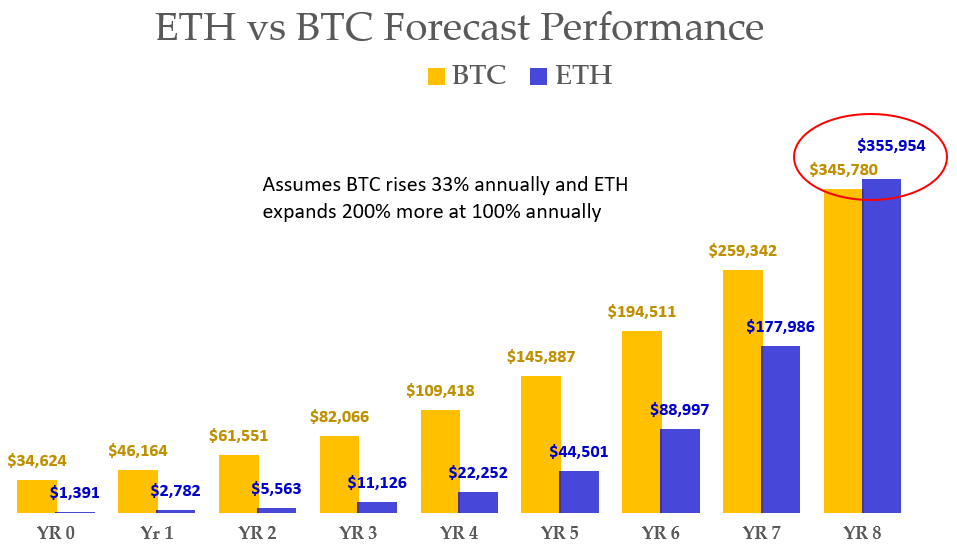

Forecasting XRP price trends involves various methodologies, including technical analysis, fundamental analysis, and sentiment analysis. These methods help traders anticipate potential price movements based on historical data and market conditions.Expert opinions on the future of XRP vary, with some analysts predicting bullish trends while others caution against regulatory challenges. Current data suggests that XRP may experience volatility influenced by market dynamics and investor sentiment.Different scenarios for XRP's future price can be organized based on varying market conditions:

| Market Condition | Price Projection (USD) |

|---|---|

| Bullish Market | 5.00 |

| Stable Market | 2.50 |

| Bearish Market | 0.50 |

Risk Management in XRP Trading

Implementing risk management strategies tailored for trading XRP is essential to protect investments. These strategies include diversification, position sizing, and the use of stop-loss orders.Best practices to minimize risks while trading XRP involve:

- Setting clear entry and exit points

- Utilizing stop-loss orders to limit losses

- Diversifying investments across multiple cryptocurrencies

- Regularly reviewing and adjusting trading strategies

The significance of setting stop-loss orders cannot be overstated, as they help limit potential losses during unfavorable market movements. Properly managing position sizes also plays a crucial role in maintaining a balanced approach to trading XRP.

Final Review

In summary, the xrp coin chart is more than just a visual representation of price; it encapsulates the story of XRP's journey and its potential future. By leveraging historical data, market sentiment, and technical indicators, traders can enhance their strategies and make more informed decisions. As the cryptocurrency landscape evolves, staying updated on XRP trends will be crucial for those looking to capitalize on its opportunities.

Top FAQs

What is an XRP coin chart?

An XRP coin chart visually represents the price movements of XRP over time, helping traders analyze trends and make informed decisions.

How often should I check the XRP coin chart?

It depends on your trading strategy; daily for swing traders and more frequently for day traders to capture short-term movements.

What patterns should I look for in XRP charts?

Look for patterns like head and shoulders, triangles, and flags, which can indicate potential future price movements.

Can I trade XRP without understanding the chart?

While it's possible, understanding the chart greatly enhances your ability to make informed trading decisions.

What tools can I use for analyzing XRP coin charts?

Popular tools include CoinMarketCap, TradingView, and Binance; they offer various features for in-depth analysis.