Ethereum To Buy The Ultimate Guide For Investors

Kicking off with ethereum to buy, this guide dives deep into the world of Ethereum and its exciting potential as an investment. As one of the leading cryptocurrencies, Ethereum offers unique features and opportunities, particularly through its smart contracts and decentralized applications.

Understanding Ethereum is crucial; beyond being a cryptocurrency, it represents a robust platform for innovation in blockchain technology. With the rise of decentralized finance (DeFi), knowing when and how to invest in Ethereum can set you up for potential financial gains in this evolving market.

Understanding Ethereum

Ethereum is a decentralized open-source blockchain system that enables developers to build and deploy applications, commonly referred to as decentralized applications (dApps). At its core, Ethereum facilitates the creation of smart contracts—self-executing contracts with the terms of the agreement directly written into code. This groundbreaking technology allows for trustless transactions between parties, eliminating the need for intermediaries.The significance of smart contracts in the Ethereum ecosystem cannot be overstated.

They provide the framework for dApps, enabling everything from financial services to gaming. Unlike traditional cryptocurrencies such as Bitcoin, which primarily serve as digital currency, Ethereum's versatility lies in its ability to power various applications and services. This makes Ethereum a unique player in the cryptocurrency space, setting it apart from others that focus solely on peer-to-peer transactions.

Reasons to Buy Ethereum

Investing in Ethereum comes with several potential benefits that make it an attractive option for those looking to venture into the cryptocurrency market. One of the key advantages is Ethereum's robust scalability and the upcoming upgrades associated with Ethereum 2.0. This transition aims to improve the network's speed and efficiency while reducing energy consumption, making Ethereum more sustainable for the future.Ethereum also boasts a wide range of use cases in the realm of decentralized applications (dApps).

From decentralized finance (DeFi) platforms to non-fungible tokens (NFTs), Ethereum is at the forefront of innovation within the blockchain space. This diverse ecosystem enhances its value proposition, as the demand for Ethereum continues to grow as a foundational layer for new technologies.

How to Buy Ethereum

Purchasing Ethereum is a straightforward process that anyone can follow with the right guidance. Here’s a step-by-step approach:

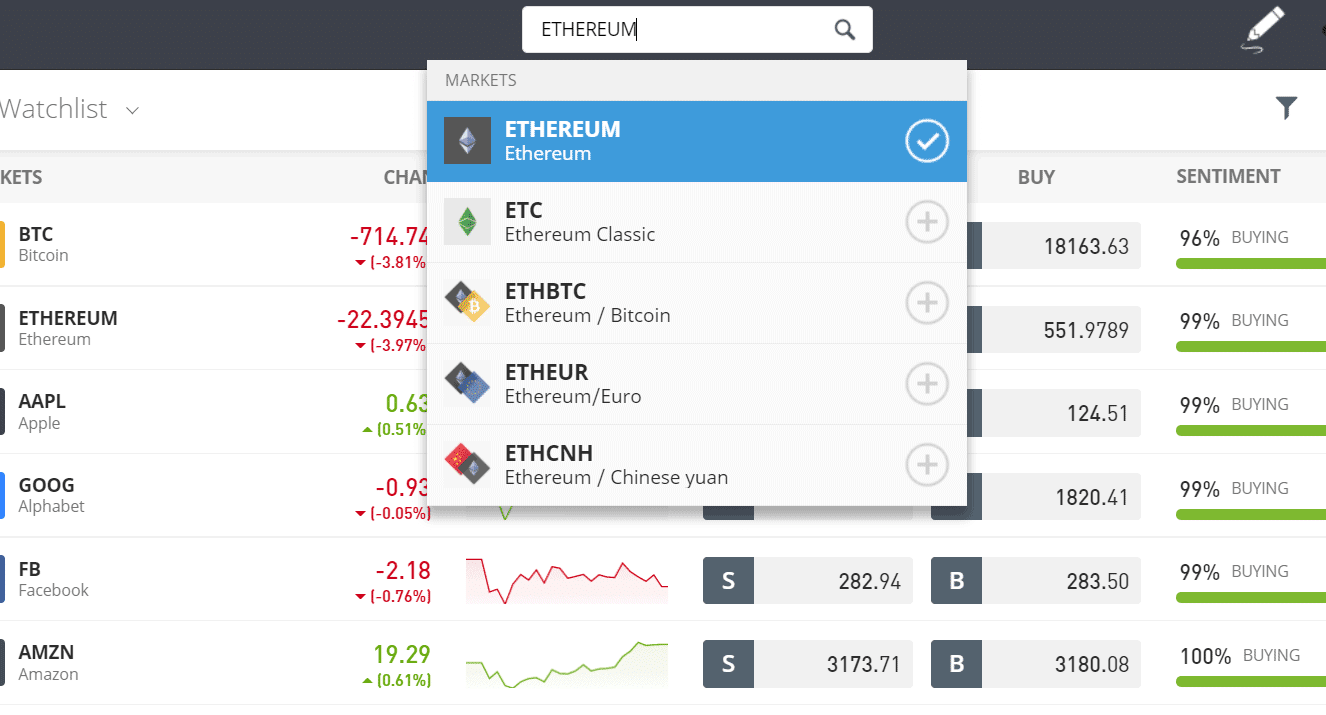

- Select a cryptocurrency exchange that supports Ethereum, such as Coinbase, Binance, or Kraken.

- Create an account by providing the required information and completing the necessary verification process.

- Add a payment method, such as a credit card or bank transfer, to fund your account.

- Navigate to the Ethereum trading section and place an order to buy Ethereum.

- Once the purchase is completed, you can choose to leave your Ethereum on the exchange or transfer it to a personal wallet for enhanced security.

Setting up a cryptocurrency wallet is an essential step for storing Ethereum safely. Wallets come in various forms, including hardware wallets, software wallets, and mobile wallets. A hardware wallet, for instance, provides a high level of security by storing your Ethereum offline, while software wallets offer convenience for everyday transactions.Transferring Ethereum from an exchange to a personal wallet is a simple yet crucial step.

After obtaining your wallet address, you can initiate a withdrawal from the exchange, ensuring that your assets are safely stored away from potential exchange vulnerabilities.

Best Practices for Buying Ethereum

Before diving into investing in Ethereum, there are several key considerations to keep in mind. The cryptocurrency market is highly volatile, and understanding the risks involved is essential. Here are some best practices to guide your investment journey:

- Do thorough research on Ethereum and its market trends.

- Consider your risk tolerance and investment strategy.

- Keep an eye on Ethereum's price volatility and market cycles to make informed decisions.

Tracking Ethereum's market trends is vital for making strategic investment choices. Utilizing tools such as price tracking websites and market analysis platforms can provide valuable insights into price movements and market sentiment.When it comes to exchanges, safety is paramount. Here’s a list of reputable exchanges for buying Ethereum safely:

- Coinbase

- Binance

- Kraken

- Gemini

- Bitstamp

Ethereum Investment Strategies

Investing in Ethereum can be approached from various angles, particularly through long-term versus short-term strategies. Long-term investors typically buy and hold Ethereum, benefiting from its potential growth over time. Conversely, short-term investors may capitalize on price fluctuations, buying low and selling high to generate quick profits.A prudent risk management approach is crucial when investing in volatile assets like Ethereum. Setting stop-loss orders and diversifying your investment portfolio to include other assets can mitigate risks associated with market swings.Diversification strategies that incorporate Ethereum can enhance your portfolio's resilience.

By balancing your investments across different asset classes, you can potentially reduce overall risk while capitalizing on Ethereum's growth prospects.

Regulatory Considerations

The impact of regulations on Ethereum transactions and investments is an important aspect to understand as the cryptocurrency landscape evolves. Different countries are adopting various approaches to cryptocurrency regulations, affecting how Ethereum and other cryptocurrencies operate within their jurisdictions.Compliance and security are paramount when buying Ethereum. Ensuring that the exchange you use adheres to regulatory standards can provide peace of mind regarding the safety of your investment.

This compliance is crucial not only for the platform's integrity but also for your protection as an investor.

Future of Ethereum

The future of Ethereum appears bright, with numerous upcoming developments that could shape its market position. As Ethereum continues to transition to Ethereum 2.0, improvements in scalability and transaction speed will likely enhance its appeal to developers and users alike.The role of Ethereum in the decentralized finance (DeFi) sector is becoming increasingly significant. With more projects being built on its blockchain, Ethereum stands at the forefront of financial innovation, providing an infrastructure for various DeFi applications.However, Ethereum may face challenges and competition in the future.

Emerging blockchain platforms and advancements in consensus mechanisms could pose threats, making it essential for Ethereum to adapt and evolve within the ever-changing cryptocurrency landscape.

Final Summary

In conclusion, investing in Ethereum presents a unique opportunity that combines innovation, potential profitability, and a transformative approach to finance. As you navigate this landscape, remember to stay informed and consider both the risks and rewards that come with buying Ethereum.

Essential FAQs

What is Ethereum?

Ethereum is a decentralized platform that enables developers to build and deploy smart contracts and decentralized applications (dApps).

How can I securely store my Ethereum?

You can store your Ethereum in a cryptocurrency wallet, either hardware or software, ensuring it's protected by proper security measures.

What are the risks of buying Ethereum?

Risks include market volatility, regulatory changes, and potential technological issues within the Ethereum network.

Can I buy a fraction of Ethereum?

Yes, Ethereum can be purchased in fractions; you don't need to buy a whole coin.

Is Ethereum a good long-term investment?

Many investors view Ethereum positively due to its continuous upgrades and the growth of its ecosystem, but it's essential to conduct thorough research.