Ethereum Vs Bitcoin Forecast A Comprehensive Analysis

When it comes to the world of cryptocurrencies, two names dominate the conversation: Ethereum and Bitcoin. Each has carved out a unique space in this digital landscape, with distinct functionalities and use cases that appeal to different audiences. As we dive into the intricacies of the ethereum vs bitcoin forecast, we'll explore their foundational differences, market trends, and future potential, painting a clearer picture for investors and enthusiasts alike.

This discussion will not only touch upon their historical development and technological advancements but also delve into the current market dynamics, regulatory challenges, and community support that shape their futures. Understanding these elements is crucial for anyone looking to navigate the ever-evolving cryptocurrency market.

Overview of Ethereum and Bitcoin

Both Ethereum and Bitcoin represent the forefront of blockchain technology, yet they serve different purposes and embody unique philosophies. Bitcoin, created in 2009 by an anonymous entity known as Satoshi Nakamoto, was the first cryptocurrency designed primarily as a digital currency. In contrast, Ethereum, launched in 2015 by Vitalik Buterin and others, expands the utility of blockchain beyond currency to include smart contracts and decentralized applications (dApps).Historically, Bitcoin has dominated the cryptocurrency market as a store of value, often referred to as "digital gold." Ethereum revolutionized this landscape by introducing a programmable blockchain, allowing developers to create dApps that can automate processes through smart contracts.

Bitcoin's primary use case remains in peer-to-peer transactions, while Ethereum facilitates a range of applications from decentralized finance (DeFi) to non-fungible tokens (NFTs).

Market Trends and Price Forecasts

Recent trends indicate a fluctuating yet upward trajectory for both Bitcoin and Ethereum, driven by increased institutional interest and adoption. Factors influencing these price movements include regulatory developments, technological advancements, and macroeconomic conditions.

| Cryptocurrency | 2021 Price (Year-End) | 2022 Price (Year-End) | 2023 Forecast |

|---|---|---|---|

| Bitcoin | $46,306 | $16,547 | $25,000 - $35,000 |

| Ethereum | $3,688 | $1,193 | $2,000 - $3,500 |

Technological Advancements

Ethereum stands out for its smart contract capabilities, enabling developers to create automated agreements that execute when certain conditions are met. This feature significantly differs from Bitcoin, which primarily focuses on transactions and security. Recent updates, particularly Ethereum 2.0, aim to enhance scalability and reduce energy consumption through a shift from proof-of-work to proof-of-stake consensus mechanisms.Bitcoin, on the other hand, is gradually implementing scaling solutions like the Lightning Network to expedite transaction processing and lower fees.

While Ethereum's technological advancements lean towards versatility and programmability, Bitcoin emphasizes security and stability.

Investment Perspectives

Investing in cryptocurrencies inherently involves risks, and both Ethereum and Bitcoin come with their unique set of factors. Bitcoin's long-standing reputation as a stable asset contrasts with Ethereum's potential for higher volatility due to its innovative nature and rapid growth in use cases.

- Bitcoin: Generally perceived as a safer investment with established market presence.

- Ethereum: Presents opportunities for significant rewards through dynamic projects and applications.

- Institutional support for Bitcoin may shield it from extreme price swings.

- Ethereum's constant evolution may lead to unforeseen market reactions.

Regulatory Environment

The regulatory landscape surrounding cryptocurrencies is evolving, with both Bitcoin and Ethereum facing scrutiny from governments worldwide. Regulations can significantly impact market sentiment and adoption rates.Countries like El Salvador have embraced Bitcoin as legal tender, while the European Union is working towards a comprehensive framework for cryptocurrencies. Conversely, some nations have imposed strict regulations that could stifle innovation.

Community and Ecosystem Development

Both Ethereum and Bitcoin benefit from robust communities and developer engagement. Ethereum's ecosystem is home to a plethora of dApps, thriving on innovation and collaboration, while Bitcoin's community focuses on enhancing security and increasing mainstream adoption.

| Cryptocurrency | Community Initiatives | Development Activities |

|---|---|---|

| Bitcoin | Educational programs, meetups, and hackathons | Scaling solutions, wallet improvements, security audits |

| Ethereum | Developer grants, hackathons, community forums | Protocol upgrades, DeFi projects, NFT marketplaces |

Future Predictions

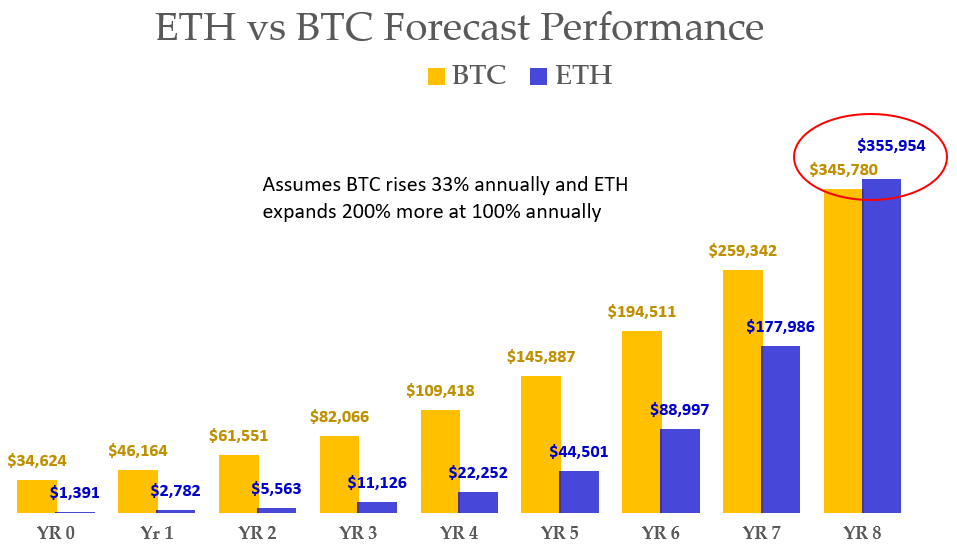

Expert opinions on the future of Bitcoin and Ethereum suggest diverging paths influenced by technological advancements and market dynamics. With Ethereum's ongoing upgrades and expanding use cases, some analysts predict it could surpass Bitcoin in terms of market capitalization.Global economic conditions, including inflation rates and regulatory changes, will play a crucial role in shaping the future of both cryptocurrencies.

- Potential technological breakthroughs that enhance scalability and security.

- Increased adoption of cryptocurrencies by institutional investors.

- Global regulatory clarity that supports innovation.

Closing Notes

In summary, the ethereum vs bitcoin forecast reveals a dynamic interplay between two powerful cryptocurrencies, each with its own strengths and challenges. As market trends shift and technological innovations emerge, investors must stay informed about the factors influencing both assets. Ultimately, whether you lean towards Bitcoin's stability or Ethereum's versatility, understanding these forecasts will help you make more informed decisions in your investment journey.

FAQ Compilation

What are the main differences between Ethereum and Bitcoin?

Bitcoin is primarily a digital currency, while Ethereum serves as a platform for decentralized applications and smart contracts.

Which cryptocurrency is more volatile?

Historically, Ethereum has shown greater price volatility compared to Bitcoin, largely due to its evolving technology and broader use cases.

What impacts the price of Ethereum and Bitcoin?

Prices are influenced by market demand, regulatory news, technological advancements, and macroeconomic factors.

Can Bitcoin and Ethereum coexist?

Yes, they cater to different needs within the cryptocurrency landscape and can provide complementary benefits to investors.

What is Ethereum 2.0?

Ethereum 2.0 is an upgrade aimed at improving the network's scalability, security, and sustainability through a shift from proof-of-work to proof-of-stake.